sales tax calculator memphis tn

We offer same day electronic filing and promise to get. As far as sales tax goes the zip code with the highest sales tax is 37501 and the zip code with the lowest sales tax is 38125.

Tennessee Paycheck Calculator Smartasset

New Tazewell TN.

. There is no applicable special tax. JRs Tax Service has been in business since 1992 and specializes in fast and accurate tax preparation. Counties cities and districts impose their own local taxes.

Kingsport TN 37660 Phone. Calculator for Sales Tax in the Memphis. For more information please call the Shelby County Clerks Office at 901 222.

The Memphis sales tax rate is. Automating sales tax compliance can. The Tennessee state sales tax rate is currently.

WarranteeService Contract Purchase Price. The term single article means any item that is considered by. The current total local sales tax rate in Memphis TN is 9750.

TAX DAY NOW MAY 17th - There are -380 days left until taxes are due. Has impacted many state nexus laws and sales tax collection requirements. Real property tax on.

Start filing your tax return now. The Tennessee sales tax rate is 7 as of 2022 with some cities and counties adding a local sales tax on top of the TN state sales tax. Box 2751 Memphis TN 38101.

Within Memphis there are around 54 zip codes with the most populous zip code being 38134. California are 1240 more expensive than Memphis Tennessee. M-F 8am - 5pm.

The replacement of titles and noting of liens can be processed and picked up or mailed in 3 business days. 2022 Cost of Living Calculator for Taxes. The state single article sales tax and the local option single article sales tax limitation will apply to a lease of tangible personal property if the tangible personal property being leased qualifies as a single article.

See reviews photos directions phone numbers and more for Sales Tax Calculator locations in New South Memphis TN. Tennessee has a 7 statewide sales tax rate but also has 307 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 2614 on top. M-F 8am - 5pm.

Tennessee has the highest overall sales tax in the country with combined state and local rates averaging 955. WarranteeService Contract Purchase Price. Vehicle Sales Tax Calculator.

Vehicle Sales Tax Calculator. The local tax rate may not be higher than 275 and must be a multiple of 25. A full list of locations can be found below.

US Sales Tax Tennessee Shelby Sales Tax calculator Memphis. The County sales tax rate is. Tennessee TN Sales Tax Rates by City A.

The Tennessee sales tax rate is currently. All local jurisdictions in Tennessee have a local sales and use tax rate. The sales tax is Tennessees principal source of state tax revenue accounting for approximately 60 of all tax collections.

Tennessee also has the highest beer tax in the nation at 129 per gallon. The Shelby County sales tax rate is. Rates include state county and city taxes.

New South Memphis TN Sales Tax Rate. Motor Vehicles Title Applications. Sales Tax Calculator Sales Tax Table.

The results are rounded to two decimals. The December 2020 total local sales tax rate was also 9750. Easy Online Tax Calculations.

For tax rates in other cities see Tennessee sales taxes by city and county. E-PIC One Sales Tax Automation - Avalara. The latest sales tax rates for cities starting with A in Tennessee TN state.

The minimum combined 2022 sales tax rate for Memphis Tennessee is. To calculate the amount of your taxes multiply the assessed value of your property times the tax rate divided by 100. Before-tax price sale tax rate and final or after-tax price.

Please click on the links to the left for more information. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Tennessee Department of Revenue.

Memphis Tennessee and Carlsbad California. Memphis collects the maximum legal local sales tax. The Sales Tax Calculator can compute any one of the following given inputs for the remaining two.

To review the rules in Tennessee visit our state-by-state guide. To lookup the sales tax due on any purchase use our Tennessee sales tax calculator. This amount is never to exceed 3600.

Washington Tennessee and Texas all generate more than 50 percent of their tax revenue from the sales tax and several of these states raise nearly 60 percent of their tax. Local Sales Tax is 225 of the first 1600. Our free online Tennessee sales tax calculator calculates exact sales tax by state county city or ZIP code.

Memphis in Texas has a tax rate of 825 for 2022 this includes the Texas Sales Tax Rate of 625 and Local Sales Tax Rates in Memphis totaling 2. The 2018 United States Supreme Court decision in South Dakota v. Sign up for E-Newsletter Home.

Bristol TN 37621 Phone. Purchases in excess of 1600 an additional state tax of 275 is added up to a. Did South Dakota v.

Cost of Living Indexes. View and print an Application for Replacement Title instructions for completion are included with the form. 2020 rates included for use while preparing your income tax deduction.

Sales Tax Calculator Sales Tax Table. The sales tax is comprised of two parts a state portion and a local portion. The local tax rate varies by county andor city.

Fill in price either with or without sales tax. Johnson City 423 854-5321. The 975 sales tax rate in Memphis consists of 7 Tennessee state sales tax 225 Shelby County sales tax and 05 Memphis tax.

The fee to replace a title or note a lien is 13. On the other hand Tennessee homeowners probably arent crying over the states property taxes which have an average effective rate of 064 15th-lowest. There is base sales tax by Tennessee.

15 - Tennessee Use Tax View Main. Try our FREE income tax calculator. Wayfair Inc affect Tennessee.

The local sales tax rate and use tax rate are the same rate. You can print a 975 sales tax table here. Local sales and use taxes are filed and paid to the Department of Revenue in the same manner as the state sales and use taxes.

State Sales Tax is 7 of purchase price less total value of trade in. Sales. The general state tax rate is 7.

Memphis is located within Shelby County Tennessee. Local collection fee is 1. Ad E-PIC One Sales Tax Automation.

Sales Tax State Local Sales Tax on Food. This is the total of state county and city sales tax rates.

Tennessee Sales Tax Rates By City County 2022

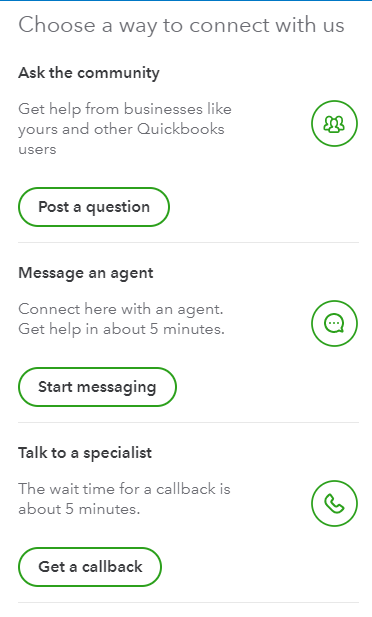

Qb Online Has Changed It Sales Tax Processing It Does Not Work For Me Is Anyone Else Having Problems With New Sales Tax System

Qb Online Has Changed It Sales Tax Processing It Does Not Work For Me Is Anyone Else Having Problems With New Sales Tax System

Is Food Taxable In Tennessee Taxjar

Tax Filing Season 2022 What To Do Before January 24 Marca

Tennessee County Clerk Registration Renewals

Nebraska Sales Tax Rates By City County 2022

![]()

Tennessee Income Tax Calculator 2022 With Tax Brackets And Info Investomatica

Arkansas Sales Tax Rates By City County 2022

Tennessee Sales Tax Guide And Calculator 2022 Taxjar

Qb Online Has Changed It Sales Tax Processing It Does Not Work For Me Is Anyone Else Having Problems With New Sales Tax System

Qb Online Has Changed It Sales Tax Processing It Does Not Work For Me Is Anyone Else Having Problems With New Sales Tax System

Property Tax Calculator Casaplorer

Arkansas Sales Tax Calculator Reverse Sales Dremployee

Tennessee Sales Tax And Other Fees Motor Vehicle County Clerk Knox County Tennessee Government